What is an Electronic Money Institution?

An Electronic Money Institution (EMI), surprisingly enough, is a class of financial institution that is allowed to issue electronic money (e-money) and provide associated payment services. This will usually take the form of prepaid cards, online apps and mobile wallets, but without the need of any underlying traditional bank account.

Historical Context

This could well be a throwback to the past, reflecting the the difference between the traditional role of banks as places where money was kept and used for loans and investments, and the transactional economy of money transfering between individuals, businesses and organisations.

Banks issued promissory notes for gold deposits, hence the wording “I promise to pay the bearer on demand the sum of £x” on UK banknotes, but their transactional use in commercial exchanges was largely incidental. However, as bank note usage increased, the management of currency gravitated to the organisations that were already entrusted with looking after financial assets.

This was extended as a result of the development of transactional services, such as cards, but also with systems designed to move money around such as BACS (in the UK), naturally fell to the banks either individually or collectively because of this historical connection with honesty, integrity and financial management.

As card-based retail services grew, the roles of acquirers and issuers developed, and their operations were restricted to established banks, hence the domination of RBS Streamline, Barclays Merchant Services and Lloyds Cardnet.

There was no reason, other than the banks’ existing relationships with cash, that made them the ideal candidate for transaction processing, but at the time, there were no other candidates, and contemporary legislation also restricted any organisations other than banks from joining the game.

The banks’ monopoly has since been cast to one side, which has opened up the market to alternative organisations, and this has since become big business.

It makes sense, therefore, to separate the wholesale storage and transmission of funds in bulk, which is what the banks do, from the consumer requirement for retail transactions, which is what transaction processing organisations do.

The Electronic Money Institute is essentially an organisation that supports card, and other, transactions for consumers and merchants, whilst leaving the cash services in the hands of the banks. More on this later.

What does an EMI do?

An EMI, or Electronic Money Institution, is a regulated financial institution, but it isnt isn’t a bank. The Electronic Money Institution is a construct of the European Union and is regulated through a series of EU Directives (see below).

There is nothing to prevent an organisation being both a bank and an EMI, and many organisations do just that, operating through the best vehicle for the product or service that needs to be delivered.

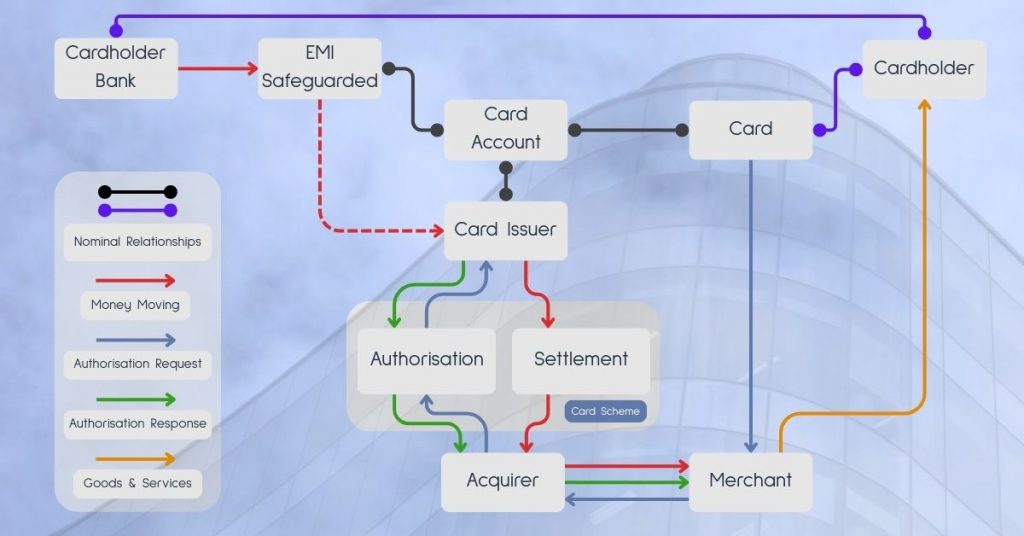

The EMI issues electronic money, which is a direct, or one-to-one representation of the money held in the cardholders’ safeguarded account (see diagram below). When the cardholder uses a card (or app or wallet) to make a purchase, the required funds will be extracted from the safeguarded account and delivered, via the settlement processes, to the merchant making the sale.

In this context, e-money is logically indistinguishable from real money, and from the perspective of the end user, don’t need a traditional bank account.

In simple terms:

- EMIs let people store money digitally and use it to pay for things online, in stores, or to send to others.

- They are regulated but they don’t offer full banking services like loans or savings accounts.

EU Directives

In the European Union, all EMIs are governed by specific laws to ensure they are operating safely and fairly.

- E-Money Directive (EMD): The main law is Directive 2009/110/EC, which is also called the Second Electronic Money Directive. This directive sets rules for what EMIs can do, how they protect customers’ money, and how they get licensed. It replaced the first EMD (2000/46/EC) to make the system stronger and clearer.

- Payment Services Directive (PSD2): The PSD2, Directive (EU) 2015/2366 also applies. This directive covers the payment services that an EMI might offer, such as money transfers, ensuring strong customer protection, transaction security and transparency.

- Anti-Money Laundering (AML) Rules: EMIs must also follow Directive (EU) 2015/849 (4th AML Directive, updated by later versions) to prevent illegal activities such as money laundering.

These directives ensure that Electronic Money Institutions are licensed, keep customers’ money safe (separated from their own funds), and follow strict security rules.

EMI Concepts and Flows

An EMI holds its cash in external, regulated bank accounts, such as settlement accounts, suspense accounts and cardholder accounts. The exact configuration of the account structure will depend on the business processes established by the EMI and the accounting practices adopted.

Cardholder: the end user the EMI services.

Cardholder Bank: this should possibly be referred to as the Funding Source, but is most likely going to be the Cardholder’s Bank. Alternative sources of funds could be PayPoint, voucher top-up or real-time Crypto Exchange. The Funding Source is usually external to the EMI itself.

EMI Safeguarded: when a Cardholder makes a deposit, that deposit, along with all other deposits from all other cardholders, are applied to the safeguarded account, which means that if the EMI fails, the cardholder deposits are safe and can be retrieved by the cardholder. The deposit is recorded in the Card Account belonging to the Cardholder.

Card Account: this is the record of the Cardholder activities and transactions. Value in the card account is maintained as a ledger balance, reflecting the contents of the safeguarded pot.

Card: this is a token, used by the Cardholder as a means of representing the Card Account. The Merchant will use the Card to generate an Authorisation Request in respect of a purchase of goods or services.

Card Issuer: the entity issuing the cards, which in this instance, is the EMI.

Merchant: a provider of goods and services to the Cardholder, who will use the Card to initiate a payment, via the Acquirer and the Issuer. See the 4-box model for further information.

Key Takeaway

Electronic Money Institutions, or something similar with a different name and re-imagined regulations, are probably what we would have had if we hadn’t assumed that the responsibility for transaction processing should fall to the banks.

Explore the Future of Payments

The global payment ecosystems continues to evolve with technologies like AI, tokenisation, and real-time payments.

Stay ahead of the game by diving deeper into the world of payment processing.

Have questions or need expert insights? Contact us.