Delivering ATM cards in the 1980s

I moved from Yorkshire to Berkshire in the 1980s, about a week after the devastation caused by the Michael Fish storm, so that more or less pinpoints the date. I left the HFC local Doncaster Branch after 18 months for the exciting and intellectually challenging world of business systems analysis. I spent four weeks, two before and two after Christmas, at the Highcliffe Hotel in Bournemouth, on a Business Systems Analysis course delivered by Hoskyns. I learned a huge amount over those four weeks, and am eternally grateful to a consultant called Dick (he looked more like a Dick than a Richard) for sharing his experiences and approach. I will share some of what I learned in the Method section as it’s good!

When I returned from the training (and a big Thank You to HFC for paying for it), I was tasked with writing the specification for a process that would allow HFC branch staff to order the “new” ATM cards for Current Account plus (CAP) customers. Customers would then be able to withdraw cash from the growing network of ATMs rather than write a cheque in one of the local offices.

I put everything I had learned, using data flow diagrams and 3rd normal form, into developing a logical process that could be used by my mate, the developer, to construct and implement the code in a logical and coherent manner. A lot of work went into that relatively simple card ordering process, but it made for a perfect learning experience. I had to design the user interface, the back-end reports and then look at the remedial procedures for when cards were undelivered. It was a lot to do but it was manageable, and I could see what I was achieving from start to finish.

Card Manufacture and Personalisation

The cards were manufactured and personalised by Datacard in Havant, and I got to get a day out near the coast to see how it all worked. I have seen card production lines on many occasions since then, but as this was the first, it didn’t occur to me that this process was different. Every other card production facility that I have seen has used flat sheets of around 100 cards, but this facility used a roll! The cards were fed into the manufacturing process on a roll of cards that was two cards wide. Hmmm!

We were given the guided tour and were shown how the cards were built up in layers. We saw how the magnetic stripe was added, along with the signature panel on the back, and we learned about some of the security features that were built into the cards to frustrate the fraudsters. We then watched as cards were fed into the personalisation machine, had the numbers and letters embossed, and the data written to the stripe. Finally we saw how the cards were mounted on card carriers and then stuffed into pre-addressed envelopes.

Magnetic Stripe Data

The magnetic stripe is split into three tracks, but the ATMs and ATM networks required only Track II to be present.

Track 2 of a magnetic stripe uses a 5-bit ASCII character set for encoding data. This allows for only 16 unique characters, including the digits 0-9 and six special characters :, ;, <, =, >, and ?. The primary account number (PAN), expiration date, service code and discretionary data are typically encoded on track 2 using this character set.

At the time, the minimum data content required for an ATM card was generally accepted as being:

;nnnnnnnnnnnnnnnnnnn=nnnn?

The magnetic stripe data began with a Start Sentinel (“;“) followed by the PAN, which was anything between 13-digits and 19-digits long, the PAN was then followed by a field separator (“=“) and the expiry date, with the last character, the End Sentinel, being represented by a (“?”).

The absolute minimum, however, was simply the PAN:

;nnnnnnnnnnnnnnnnnnn?

But this was fifty years ago …

Card Design?

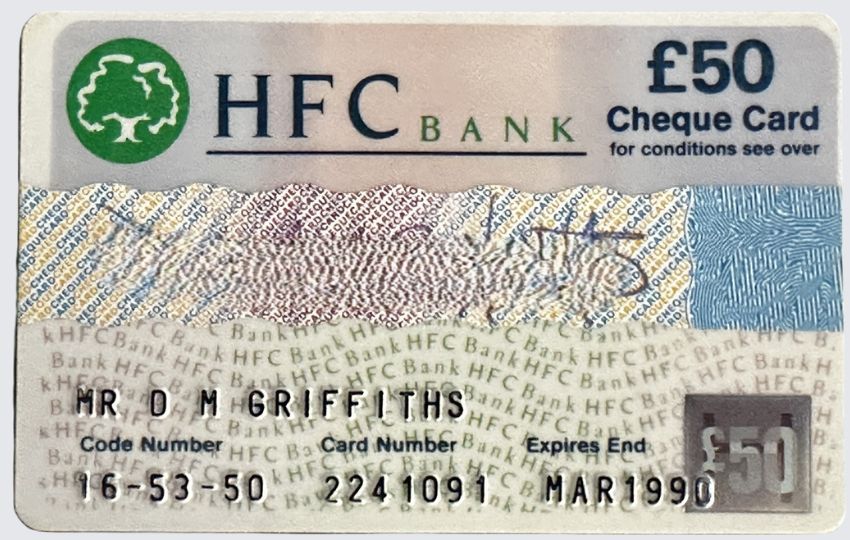

Looking at the photograph of the cheque guarantee card, it’s fairly evident that the top panel is offset to the right, as is the rolling HFC Bank text below the signature panel, which is not what was intended.

The “Code Number” is the Sort Code, although 16-53-50 is now invalid, and the “Card Number” is the number that the retailer would have had to write on the back of your cheque for it to be guaranteed by the bank. The “Expires End” is self-explanatory, and this card expired in 1990, which means that it would have been issued around 1987.

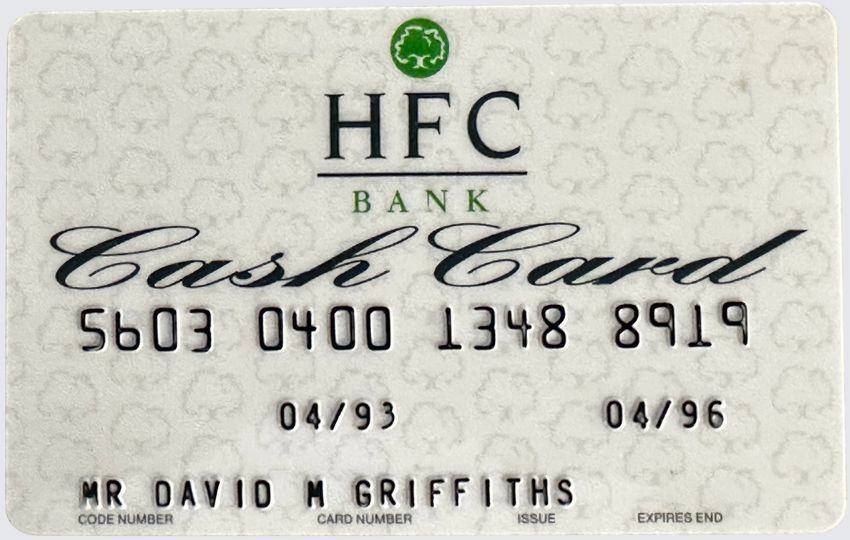

The Cash Card would have been issued using the system that was designed by me. I remember going into the local office and actually requesting one using my process The card uses similar terminology to the cheque guarantee card but again without proper consideration for the wording. There is no “Code Number”, the “Card Number” isn’t relevant, there is an expiry date but the label seems to be incidental, and “Issue Number” is something that I will explain elsewhere but serves no purpose here.

It looks like this card was designed, proofed and then delivered without proper care, consideration or any particular attention to detail. It really should never have been approved, but sometimes they do.

Whilst there was a magnetic stripe on the Cheque Card, there was no information to be read, which is what you would expect as there was nowhere for it to be read – this was the time before swipe readers. The Cash Card, however, was readable, as you would expect, and when I read it, the magnetic stripe revealed the following information:

;5603040013488919=9604?

Exactly what you would expect!

Explore the Future of Payments

The global payment ecosystems continues to evolve with technologies like AI, tokenisation, and real-time payments.

Stay ahead of the game by diving deeper into the world of payment processing.

Have questions or need expert insights? Contact us.