Introduction

The purpose of this section, and the onward links that might otherwise be considered to be too much like following rabbits down long dark rabbit holes, is to consider exactly what the requirements of a global payment mechanism might be, based on the needs of the people, how the value in the ecosystem might move around, and how the entire infrastructure might pay for itself.

We shall be making no judgements or assumptions about technologies, existing processes, anecdotal evidence or hearsay, and we shall be following the principles outlined in the Monkey Design and Monkey Methods sections of the Payment Monkey website.

Laying the Groundwork

Am I laying the groundwork or am I simply setting the scene. When I began in the payments game, cash was still very much in evidence, cheques and cheque guarantee cards were commonplace and for those who qualified, credit cards could bridge the financial gap until payday. The technologies supporting these payment options were rubber bands, ballpoint pens and zip-zap machines.

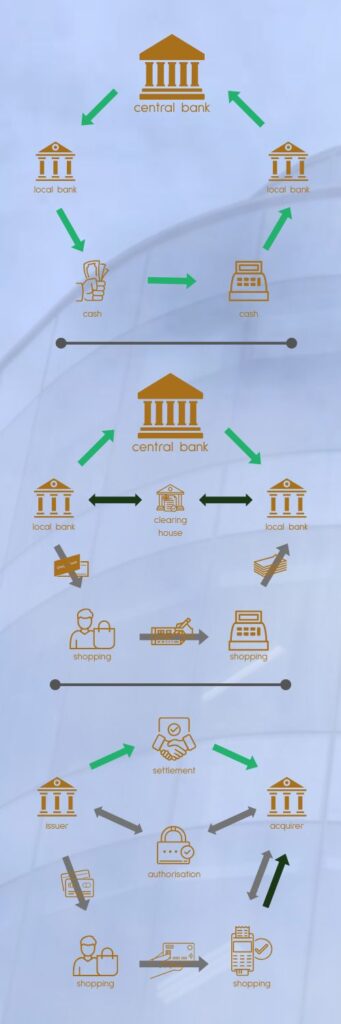

Cash would be drawn over the counter in the local bank branch, always a busy place on a Friday afternoon as this was almost the only source of cash until Monday. The withdrawn cash would change hands as it traversed the financial ecosystem on the back of retail payments and the consumption of food, drink, goods and services – until it found its way eventually back to the bank, where it completed its journey as a cash deposit, only to begin that same journey once again.

The cash was, and it still is, an integral part of any transaction; it works because it is accepted by the people using it as representing real value, and without that accepted recognition of its value, it has NO value! Once accepted as having value, it can be exchanged directly for goods and services without the need for backend settlement processes.

Cheques, often supported by cheque guarantee cards, allowed bank account holders to move value held in the bank account associated with the cheque to a different bank account, and one that didn’t belong to the holder of the first bank account.

The cheque represents a movement of funds from one account to another without the need for any direct relationship between the two banks, or even between the two parties to the payment. The cheque represents the transfer of value from one party to another, in exchange for goods or services; the value associated with the cheque is transferred in the background, from one party’s bank account to the other party’s bank account.

The cheque differs from cash insofar as the transfer of value is separated from the act of paying, which maybe not that dissimilar in concept to the promissory notes used to represent a gold deposit in a bank vault, and the movement of that gold between vaults as a result of the exchange of said notes.

Credit Cards operate in a similar manner to cheques with the value transfer being nominally represented by the information in the card transaction, which takes place across the card ecosystem using the baking infrastructure to move real funds between accounts. The card represents the instruction, along with the information needed to complete the transfer of that value.

The credit card differs from the cheque as the former operates on the basis of consumer debt whilst the latter operates on a positive balance – accepting that credit card accounts can operate with a positive balance and bank accounts can operate in the red. The mechanics and logic of the credit card payment processes, however, are not dissimilar.

Credit card payment information represents movement of funds that can be cleared and settled in bulk in the background.

Payment Principles

Let’s design a Global Payment Service

We shall be making no assumptions about technologies, or existing processes, or anecdotal evidence or hearsay, and we shall be following the principles outlined in the Monkey Design and Monkey Methods.

Principles of Proper Payments

If you were to design a global retail payment service, how would you go about it, what components would you need, and what features would you be looking to deliver?

-

- I would argue – some might not – that it would need to be accessible to all.

- Access to generic payment services should be inexpensive.

- Payment processing for the individual should be simple and straightforward.

- Payment processing for merchants should be simple, straightforward and inexpensive.

- Data associated with payment processing should carry no intrinsic value.

The solution, if I were to start from scratch today, would look something like the existing four-party model. This model represents the best way of connecting multiple parties without requiring multiple bilateral connections.

Explore the Future of Payments

The global payment ecosystems continues to evolve with technologies like AI, tokenisation, and real-time payments.

Stay ahead of the game by diving deeper into the world of payment processing.

Have questions or need expert insights? Contact us.