What is the 4-Party Model?

The 4-party model, also known as the 4-box model, is the foundation of modern payment card systems, and this has been true for as long as there have been interoperable card payment systems – it’s true because the logic works. The 4-party model, which includes the card schemes (arguably the 5th party), is arguably the most effective and efficient method of providing the connectivity necessary to deliver global retail (and other) payment services.

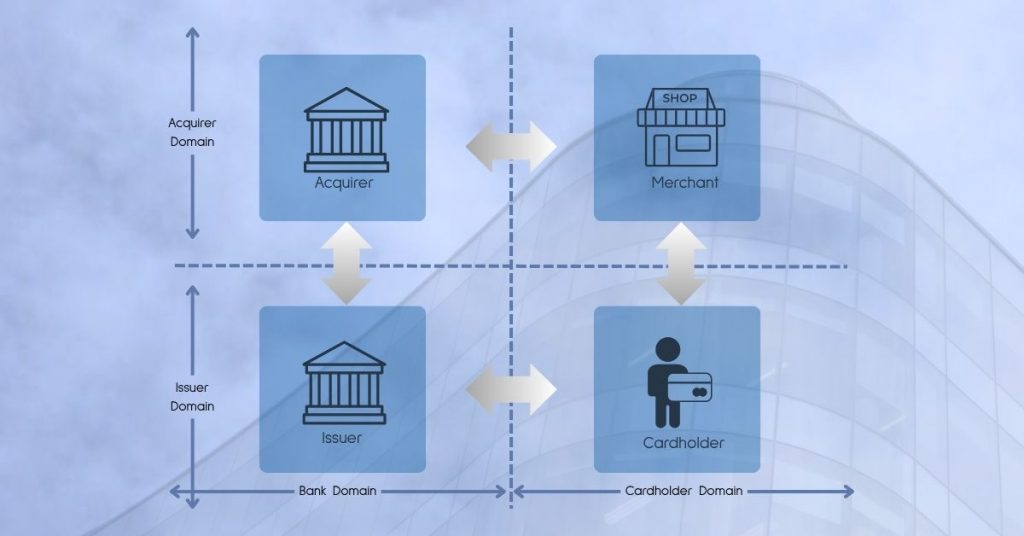

The four party model, accepting the interoperability supplied by the card schemes, describes the collaboration between four key players, or parties – cardholder, merchant, issuer, and acquirer – that together enable transactions at POS terminals, ATMs, and across online platforms.

No one party can feasibly operate all the links in the transaction processing chain, but if one party were to provide all the necessary functions, the resulting ecosystem would be closed rather than open loop, essentially defeating the object. The 4-party transaction model allows organisations to deliver specialist payment services, such as card issuing, without the need to operate the complementary merchant services or ATMs that are needed if cardholders are to use their cards. These complementary services are left to the organisations best suited to delivering them, and in this way, the 4-party model defines a framework that supports a successful global transaction processing network.

Each organisation, along with the cardholder, plays their part in realising the accepted global ability for consumers to pay for goods and services using a card. Competition exists, but it does so within the managed context of collaboration.

The card schemes hold the processes together, defining the interfaces, supporting interoperability by passing transactions across the network, and facilitating service recognition and card acceptance through their brands.

In the following, we dive into the structure, history, and significance of the 4-box model, offering insights from decades of expertise in payment processing.

The Four Parties of the 4-Party Model

At its core, the 4-box model involves four stakeholders, each with distinct roles and responsibilities:

- Cardholder: The individual or entity using a credit, debit, or prepaid card to make a purchase or access funds. They initiate transactions and rely on issuers for their cards and for the account management.

- Merchant: The business or platform that accepts card payments. Merchants process transactions via POS, ATMs, or online gateways and receive funds from acquirers.

- Issuer: The financial institution that issues the card. Issuers authenticate cardholders, authorise transactions, and manage credit or funds.

- Acquirer: The bank or processor that enables merchants to accept card payments. Acquirers pick up and route transactions received from merchants and and deposit funds into merchant accounts.

Card schemes (e.g., Visa, Mastercard) act as the glue, connecting issuers and acquirers through standardised rules and networks.

A Brief History of the 4-Party Model

The 4-party model emerged in the late 1960s as payment cards evolved from closed-loop systems (e.g., Diners Club) to open-loop networks. Bank of America’s BankAmericard (now Visa) pioneered the separation of issuers and acquirers, allowing multiple banks to participate. By the 1970s, Visa and Mastercard formalised this model to create the scalable, interoperable systems that persist today.

The model’s global adoption was fueled by electronic authorisation in the 1980s, EMV chip cards in the 1990s, and digital wallets in the 2010s. Today, electronic authorisations underpin most card-based transactions, and have been adapted as needed to support innovations like contactless payments and tokenisation.

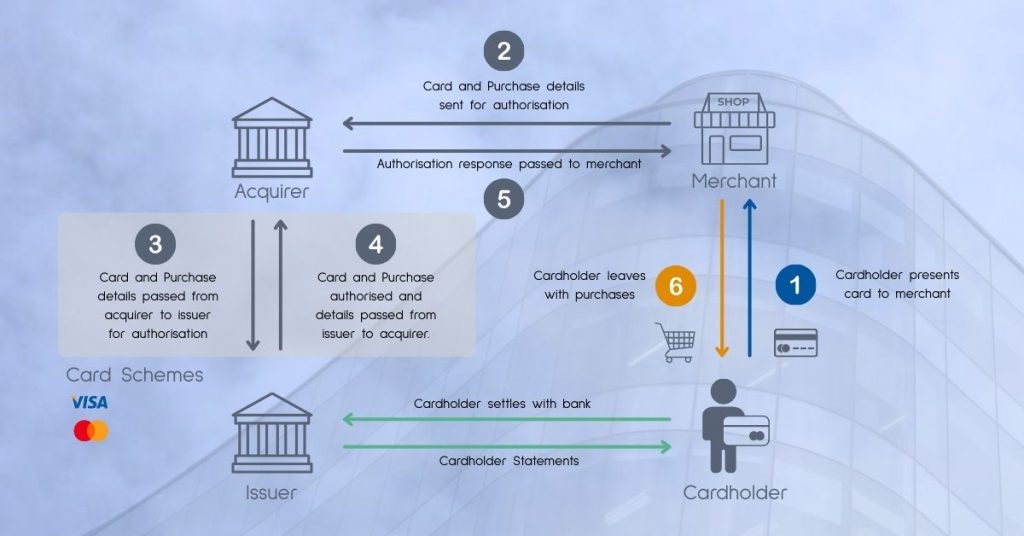

How the 4-Party Model Works

A typical card transaction involves three stages: authorisation, clearing, and settlement.

- Authorisation: The cardholder swipes, dips or taps their card at a merchant’s Point of Sale (POS). The merchant systems format and send the transaction to the acquirer, who forwards it to the appropriate card scheme. The scheme then routes it onwards to the issuer, where the request is validated, and if the funds are available, the transaction is approved. The issuer generates a response message and the POS is advised of the result.

- Clearing: The merchant groups transactions into batches (usually business day) and sends them to the acquirer. The acquirer sorts the transactions and submits them to the appropriate card scheme. The card scheme then calculates the amounts owed across the issuers and acquirers, and issues a request for settlement.

- Settlement: The issuer transfers funds drawn from the cardholder account to the card scheme, which forwards them to the acquirer. The acquirer deposits the transaction amount (minus fees) into the merchant’s account, and the issuer bills the cardholder.

Fees are complex; they are not covered here as they are not part of the logic of the 4-party model.

Click on the diagram for a step-by-step description of the process.

Variations of the 4-Party Model

Whilst the 4-Party model is standard for open-loop systems, some variations do exist:

- 3-Party Model: Used by American Express, where the issuer and acquirer are the same, simplifying the process but limiting scale.

- Regional Models: Systems like UnionPay (China) or RuPay (India) adapt the model to local regulations and preferences, such as QR code integration.

- Digital Wallets: Apple Pay, Google Pay and the like add tokenisation to the mix but still rely on the same four parties for transaction processing.

Why the 4-Party Model Matters

The 4-Party model is the cornerstone of global card payments, offering:

- Scalability: Supports thousands of issuers and acquirers in one network.

- Interoperability: Enables card acceptance across multiple regions and currencies.

- Resilience: Distributes risk across parties for system stability.

However, current challenges include high merchant fees, regulatory scrutiny (e.g., EU interchange caps), and the need for robust security to combat fraud.

Explore the Future of Payments

The global payment ecosystems continues to evolve with technologies like AI, tokenisation, and real-time payments.

Stay ahead of the game by diving deeper into the world of payment processing.

Have questions or need expert insights? Contact us.