I am sure that this video is aiming to educate its viewers on protecting themselves against ATM fraud. Its effectiveness, however, is undermined by technical inaccuracies and a superficial grasp of how payment networks, card processing systems, and banking infrastructure (should) operate.

It looks like the scams discussed in this video are limited to the USA, because it’s unlikely they would work anywhere else.

A line by line analysis of the shimmer scam

Shim or Shimmer

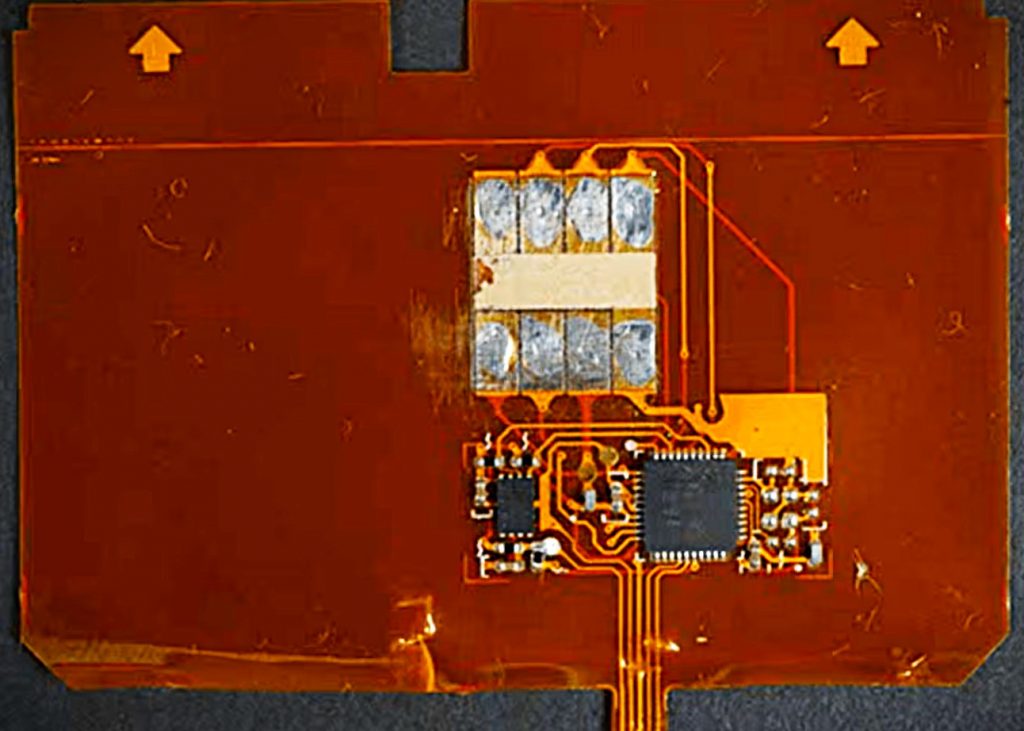

He’s talking about shims, or shimmers if you’re in the US, but they are the same thing. A shim sits in the ATM card slot, undetected by the ATM and invisible to you, and like a man in the middle, it listens to the conversation between the chip and the ATM card reader.

These shims are highly sophisticated devices – developed using a considerable amount of ATM know-how and EMV application knowledge – that passes transaction data from chip to ATM and back again, but stores only the data needed for “cloning” cards. Authorisation data generated in the course of the transaction has very little value but would occupy a significant amount of the available memory space when compared to the data retrieved from the chip. It would also add significant overheads to any wireless transmissions from shim to receiver.

Shimmer Attacks on the Increase – in the US

Chip Card Data Content

Shimmers – a US phenomenon

PIN Stuff

Accountability

Sound Advice – on the whole

This is preventable

The scammers are stepping up their game. The banks should too!

Explore the Future of Payments

The global payment ecosystems continues to evolve with technologies like AI, tokenisation, and real-time payments.

Stay ahead of the game by diving deeper into the world of payment processing.

Have questions or need expert insights? Contact us.