The Account Funding Transaction

The Account Funding Transaction (AFT) is a specialised, non-purchase transaction designed to move funds from a cardholder account to another account, such as a digital wallet, a bank account, or a peer-to-peer payment platform. The AFT facilitates seamless and secure money transfers for a variety of purposes, including account top-ups and direct payments.

The AFT is processed through the Card Scheme network, and will require authorisation to verify the cardholder’s account and to ensure sufficient funds. Following successful authentication and authorisation, the transaction is settled, thereby completing the transfer.

Visa and Mastercard have their own terminology for these transaction types, Visa uses the term Account Funding Transaction (AFT) whilst Mastercard uses Funding Transaction (FT). The rules can vary between schemes, with some use cases requiring a funding transaction for one scheme but a purchase for the other. The term, Account Funding Transaction (AFT) is used throughout this section to indicate a funding transaction.

The primary source of information for this section has been my experience, supported by the appropriate Card Scheme Guides.

A High Level View of the AFT

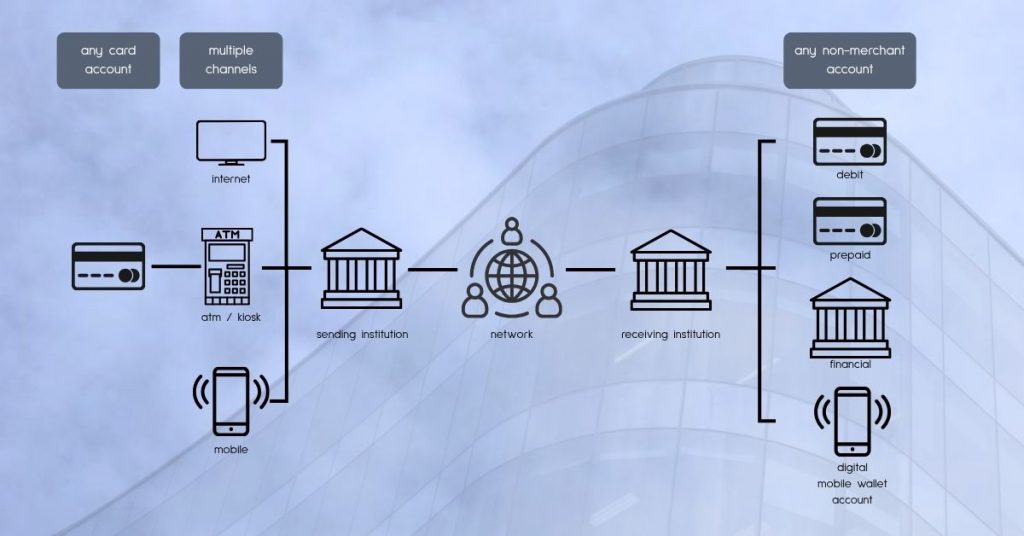

The Account Funding Transaction (AFT) is used to pull funds from a card account, with the funds pulled then being used to fund another account – either scheme or non-scheme. The transfer process is essentially, therefore, composed of two complementary transactions, one that pulls the money from the funding account and a second that pushes the money into the target account. The transaction structure of the second leg of the transfer will depend on the final use case, and destination of the money.

Account Funding Transactions are used in the following circumstances:

- prepaid card load / reload

- funding a digital wallet

- moving funds from one account to another

- P2P money transfer (via subsequent transaction)

The list is not exhaustive.

For the purpose of the Account Funding Transaction, the transfer of value falls into one of two transaction categories: Account top-ups and Direct Payments.

Account Top-up

This involves transferring funds from a cardholder account to another account held by the cardholder (digital wallet, prepaid card, or mobile payment app) to increase its balance for future use. The funds are stored in the receiving account and can be used later for purchases, transfers, or any other permitted transaction.

Direct Payments

These refer to AFTs where funds are transferred directly to another individual or entity, such as in a peer-to-peer (P2P) payment, with the intention of them fulfilling an immediate purpose, like paying back a friend, rather than being added to a store of value (wallet, prepaid card and so on).

The process for transfers falling into the Direct Payments category will complete using the Original Credit Transfer (OCT) transaction.

It’s also probably not surprising that AFTs must only be used to fund an account belonging to the same individual, or other entity, that holds the funding card account, which is not the case for an OCT.

Funding the Wallet

Card Scheme documentation makes references to the Stored Value Digital Wallet and to the Staged Digital Wallet in the context of Account Funding Transactions. A brief synopsis of stored value and staged wallet principles might help contextualise the mechanics behind the AFT transfer processes.

For further information on this interesting topic, click the button

Transaction Rules

The Account Funding Transaction is a “pull” transaction that functions in a similar manner to a purchase transaction, pulling funds from a cardholder account and applying the credit to the “wallet”.

Where the intention is to complete a person-to-person or account-to-account Money Transfer, the AFT is paired with an OCT (Original Credit Transaction), which pushes funds to any eligible account.

There is a complex set of rules that govern the use of ACT and OFT in the context of Stored Value Wallets and Staged Wallets, depending on use cases.

AFT “Pull” transaction for any non-merchant account

The Account Funding Transaction mechanics are the same as those of a purchase transaction originating from a merchant. Here, the merchant equivalent is the non-merchant account, which is essentially any account capable of storing value. The “wallet” entity, in the name of the cardholder, initiates an authorisation request against the cardholder’s account, wherever that account is maintained. The request is authorised against the cardholder’s available balance and the funds are made available in the wallet, immediately.

Account Funding Transactions – considerations

Any AFT program is going to require a relationship with an Acquirer, which includes Acquirers, Merchants and Service Providers, assuming the Service Provider has a relationship with an Acquirer. This relationship is necessary as it falls to the Acquirer to submit authorisation requests to the card scheme.

The “wallet” provider is required to provide the funding for the incoming AFTs until the funds are received via settlement, as the ability to use the funds must be immediately available to the cardholder.

In all cases, the Acquirer accepts all related transaction liabilities, and in all cases, the program must be approved by the card scheme prior to launch.

Explore the Future of Payments

The global payment ecosystems continues to evolve with technologies like AI, tokenisation, and real-time payments.

Stay ahead of the game by diving deeper into the world of payment processing.

Have questions or need expert insights? Contact us.