Open Banking

Open Banking is a financial services model that allows consumers to share their banking data securely with third-party service providers via APIs (application programming interfaces).

The Open Banking framework is enabled by regulation in regions like the UK and EU, with the intention of increasing competition, innovation, and consumer control in personal financial services.

Through Open Banking, users can access new tools for budgeting, payments, and financial planning by permitting financial institutions and fintechs to access their account information.

It is intended to shift the ownership of data to the consumer, with the promise of promoting transparency and empowering smarter choices. Security and consent are central to the process, to ensure that data sharing occurs only with explicit permission and under regulated frameworks.

Open Banking and the Apple Wallet

This is one of the best applications of Open Banking that I have seen! It is exactly what I would have asked for had I been asked, and I dare say that it’s pretty much what any apple wallet user would have asked for, if they had been asked.

Apple wallet is good – we can discuss the manufactured need for tokenisation elsewhere – but the initial problem was that a cardholder was only able to see those card transactions that had been initiated by the card in the wallet. That in itself was quite nice, but seeing the transaction history of the card account in that one place was awesome! Not a word I use lightly as it’s a bit over the pond.

It was Saturday lunchtime in Ware, and I was suddenly overwhelmed by an urge to purchase Fish & Chips – a rare lunchtime treat for a couple of old gimmers like me and Tina – but I had forgotten to bring my cards. I used the TSB card safely stored in my apple wallet, which for a younger person is now as much a second nature as debit cards were in my “youth”.

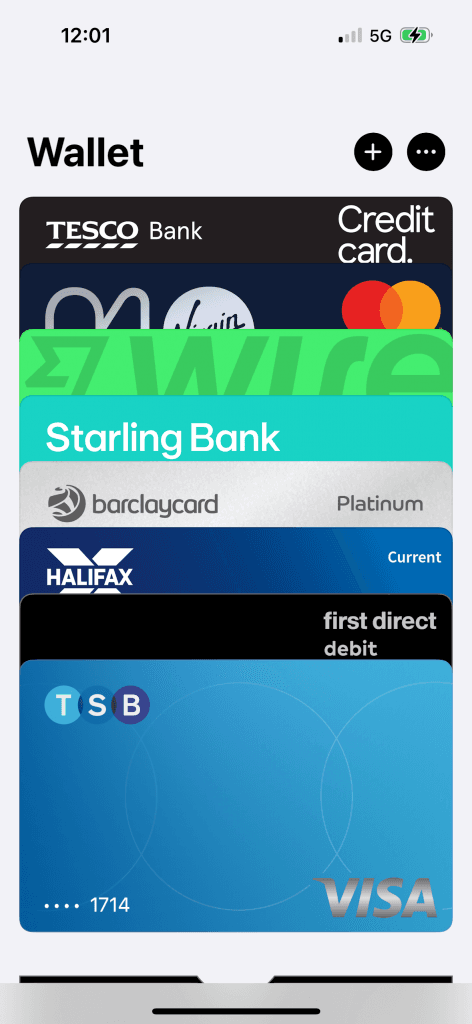

I noticed when I opened my apple wallet, whilst waiting for the chef, that I was being asked if I wanted to see Balances and Transaction History for this account. Open Banking had arrived in the Apple Wallet for my TSB account – for completeness, most of the other accounts were also enabled for Open Banking.

Check out the process flow and relive my TSB Open Banking experience.

Open Banking Benefits

I asked Chat GPT to look for the benefits that Open Banking might bring, and this is what the AI came back with – it’s a good starting point, but I don’t necessarily agree.

for consumers

- greater financial control

- better products and services

- improved transparency

- convenience

- enhanced security

for business and merchants

- faster payments

- lower transaction costs

- better customer insights

- streamlined lending

for banks and fintechs

- innovation catalyst

- new revenue streams

- customer retention

- regulatory compliance

for the economy

- increased competition

- financial inclusion

Open Banking Challenges

I asked Chat GPT to go have a look and find me some of the challenges you might associate with Open Banking, and this is what the AI came back with – it’s a good starting point, but to what extent has it got it right?

for consumers

- awareness and acceptance

- concerns about privacy and security risks

- consent fatigue

- limited awareness

for business and merchants

- complexity of integration

- issues relating to reliability

- dependence on bank APIs

for banks and fintechs

- loss of competitive edge

- revenue cannibalisation

- compliance burden

for the financial ecosystem

- fragmentation and lack of standardisation

- regulatory gaps

- innovation risks

I have a few more of my own!

Analysing Open Banking Payments

It’s only a payment; how hard can it be?

The Gestalt School is a psychological theory that emerged in early 20th-century Germany and focussed on how humans perceive and make sense of patterns and wholes. Gestalt psychologists believe that “the whole is greater than the sum of its parts”.

The same principles apply to payments. Payment systems are not defined by the specifications of the data flows, just as consciousness isn’t defined by electrical activity across neurons. The whole is greater than the sum of the parts and Open Banking is more than a specification.

Drivers for Open Banking

The drivers were a mix and match of consumer empowerment, innovation, competition and security, with the EU (via PSD2) being a primary force behind the concept of regulated API-based Open Banking services. The UK opted the vision and set an example followed by many other countries.

The drivers fall into two distinct categories:

- empowering consumers through the sharing of personal financial information

- challenging the card scheme monopolies by introducing competition from alternative payment mechanisms

There are other drivers, but they are generally dependant on the services and facilities listed above. The Open Banking data sharing mechanism provides a framework for authenticating individual parties, and then authorising the transfer of information according to the wishes of those parties. The Open Banking payment mechanism follows the same authentication and authorisation approach, but completes the process by creating a push payment from the account of one party to that of another.

The PSD2 (2015) came into effect from January 2018, mandating that banks open up access to customer account data and payment initiation services to regulated third-party providers, with the appropriate customer consent.

The Open Banking initiative was designed to unify and modernise the EU payments market, encourage innovation and enhance consumer protection. The UK’s implementation of Open Banking became one of the most structured and visible ecosystems to date.

The Open Banking Payment Transaction

- User Initiates Payment

- User starts payment on merchant site

- User chooses “Pay by Bank” or “Open Banking”

- PISP is invoked

- Merchant redirects User to PISP

- PISP gathers payment details: amount, payee account, reference …

- User Selects Bank

- PISP presents list of Banks

- User selects Bank from list

- User is Redirected to bank

- User is redirected to banks authentication portal

- Authentication

- Strong Customer Authentication (SCA) applied

- biometrics, SMS OTP, banking app approval

- Bank Executes Payment

- Bank initiates a credit transfer (e.g. Faster Payment)

- Confirmation of initiation sent to PISP

- Confirmation to PISP and Merchant

- PISP receives confirmation of Initiation

- Merchant notified (Webhook or API callback)

- Instant settlement or within minutes (usually)

- User Redirected Back

- User is returned to the Merchant

- payment Status page confirms success or failure

What does it all mean?

Stepping through the Open Banking process outline, it becomes clear that the payment is made up of two distinct but connected operations. The first operation consists of a series of authentication and authorisation processes employed to establish the validity of the parties and the availability of the funds, and the second operation is the actual transfer of value from the payer account to that of the payee.

The initial authentication and authorisation process is not dissimilar in concept to that of 3D-Secure, and like 3DS, involves a lot of bouncing around across the internet.

Once this first operation is completed, the customer, the merchant and the bank will all have been authenticated, and the second operation can begin. The customer’s bank now has all the information necessary to initiate a Faster Payment to the merchant’s bank account.

The successful completion of the Open Banking payment is accompanied by a series of confirmation message flows.

Open Banking Considerations

It is clear from the interactive nature of the information flows that the Open Banking payment cannot be initiated by a card – this is not a card technology solution.

It follows that the Open Banking payment option is only compatible with devices capable of initiating and interacting with the Open Banking information flow, and with the consumer. A computer or a mobile phone is required for Open Banking.

Open Banking, as a merchant payment option, is also limited by the fact that the merchant’s point of sale, along with the customer’s mobile device, needs a robust internet connection.

At the time of writing, the implementation of Open Banking payment solutions is restricted to the virtual world of browser shopping, although physical devices are just around the corner.

Whether the original vision for Open Banking is successful or not, “Pay by Bank” – a term coined at Vocalink for a product that wasn’t Open Banking – will need to operate alongside cards, which are unlikely to disappear anytime soon. This is likely to be a troubled coexistence!

Click on the diagram for a step-by-step description of the process.

Explore the Future of Payments

The global payment ecosystems continues to evolve with technologies like AI, tokenisation, and real-time payments.

Stay ahead of the game by diving deeper into the world of payment processing.

Have questions or need expert insights? Contact us.